Global Gaming M&A Landscape - 2023 Edition

Regional Shifts, and the Rise of Decentralized Gaming Transactions

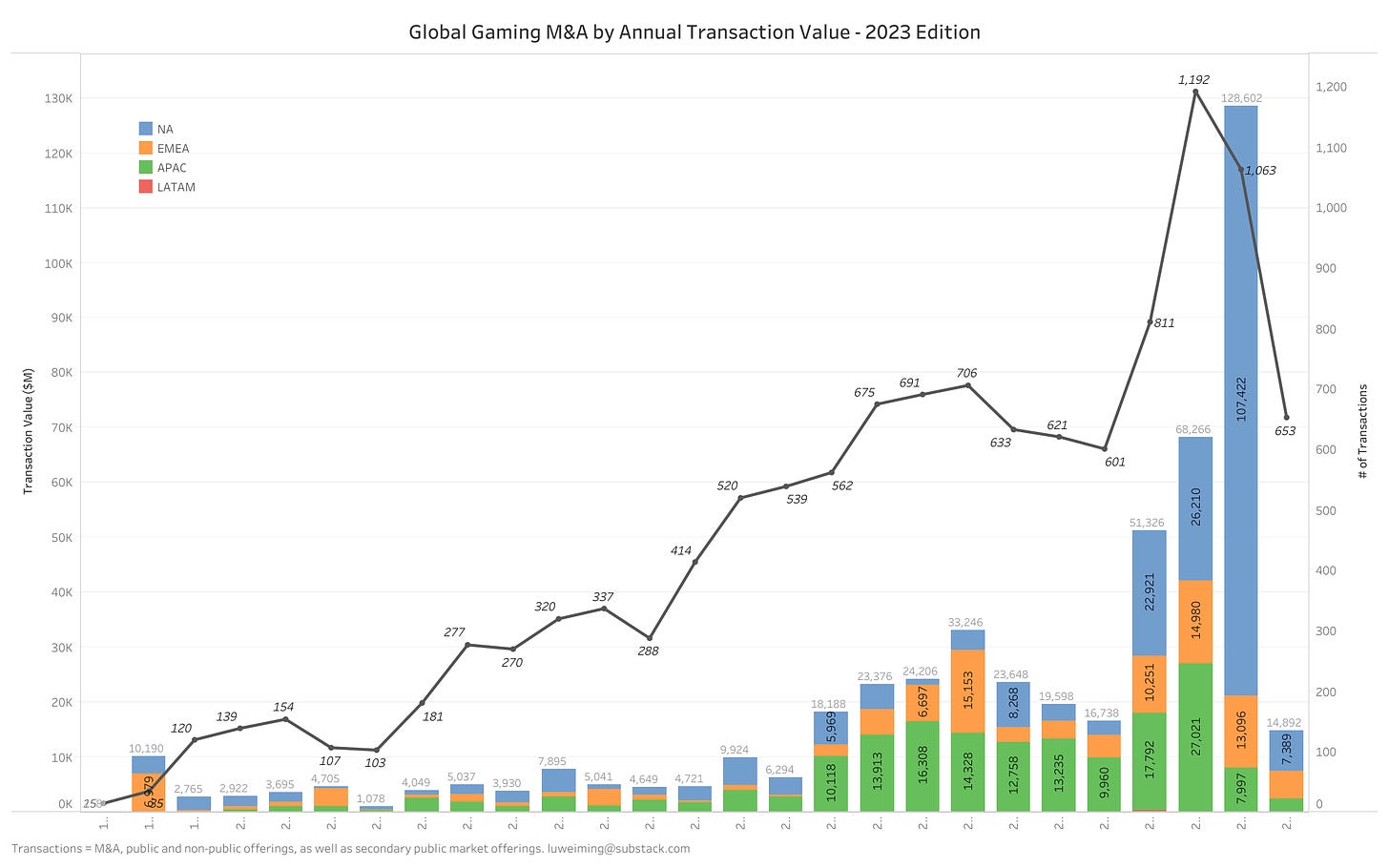

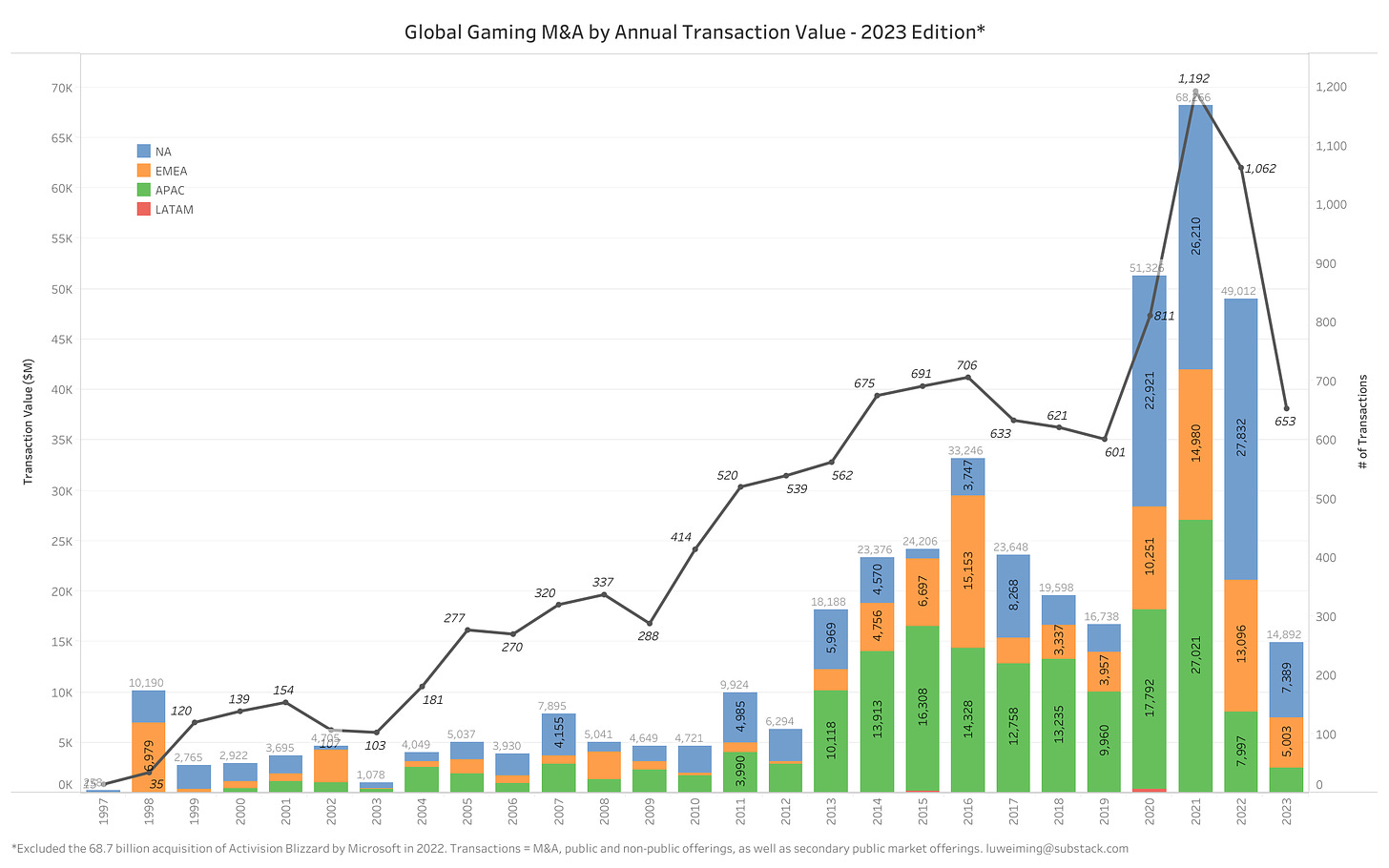

The global gaming M&A market has undergone remarkable growth over the past two and a half decades, evolving from a total transaction value of $258 million in 1997 to an average annual behemoth of $39 billion in the past decade. As we conclude the year 2023 a few days ahead of schedule, specifically on December 28, 2023, it appears that the customary end-of-year deal rush tradition did not hold true for this year.

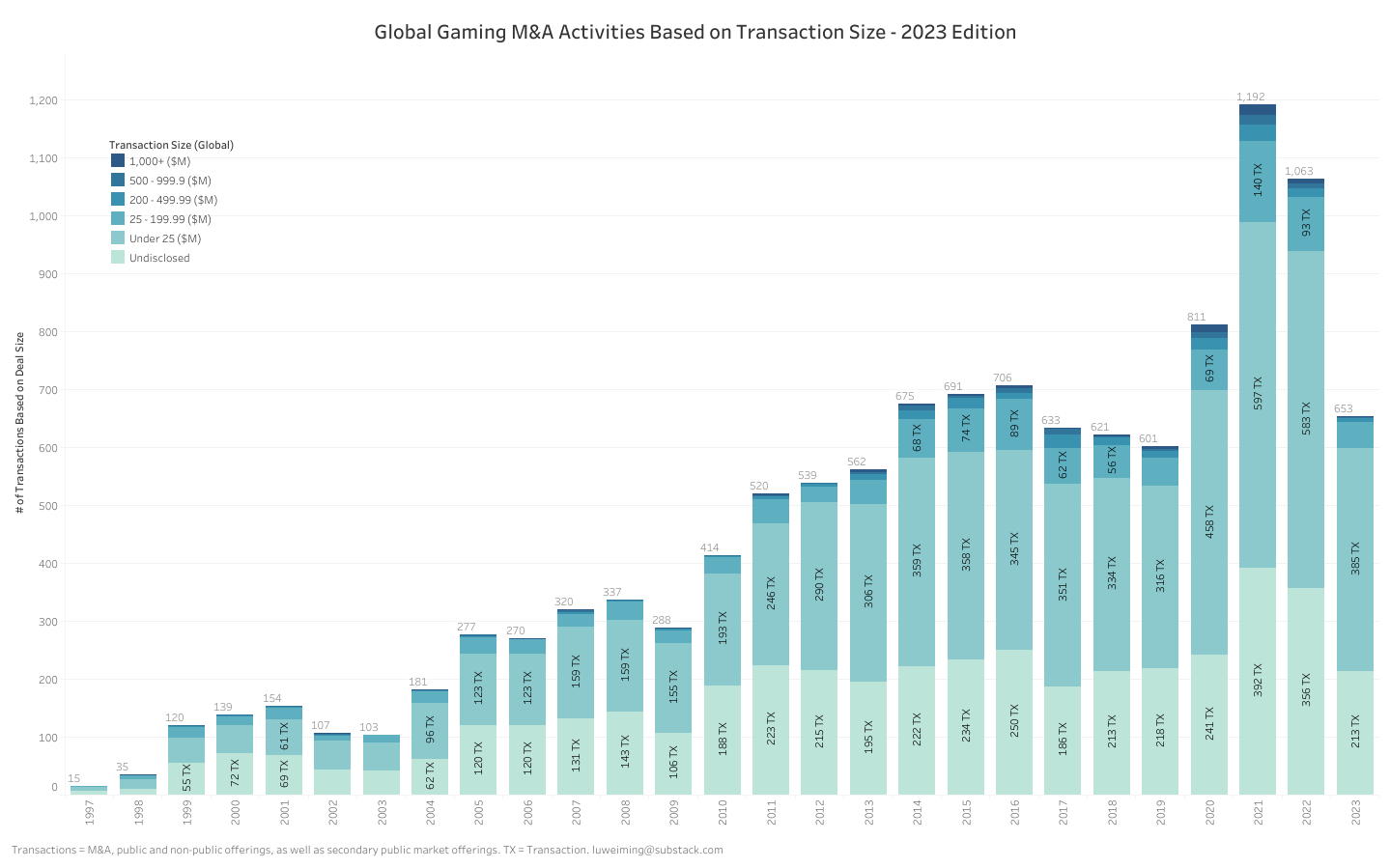

Removing the mega acquisition of Activision Blizzard from the equation, we observe that the global M&A market is reverting to the historical trend average of the 2019 level in terms of transaction volume, total transaction value, and the volume of each transaction size. Notably, investors and buyers have engaged in more smaller transactions under $25 million in 2023 than in 2019, with 385 transactions compared to 316.

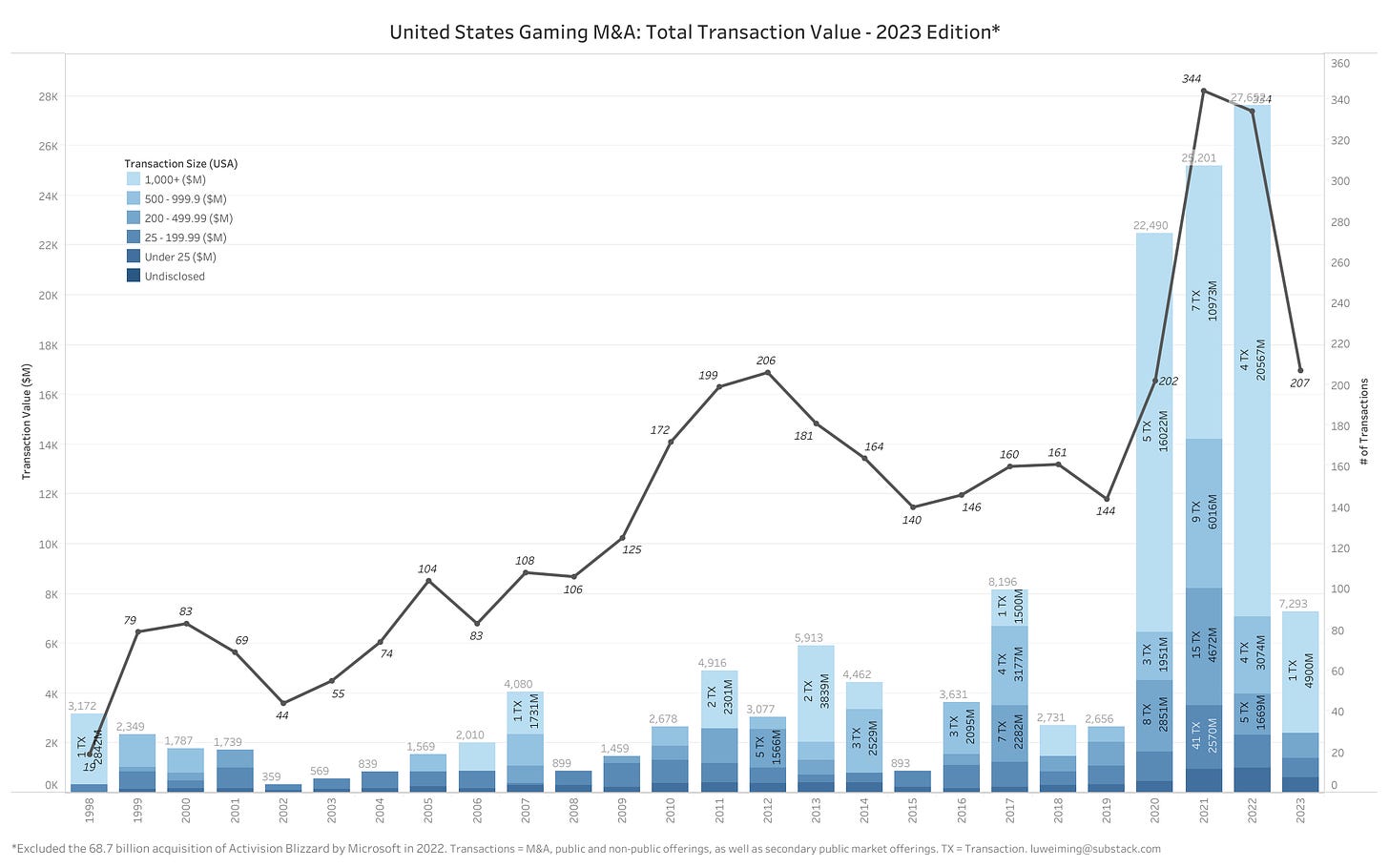

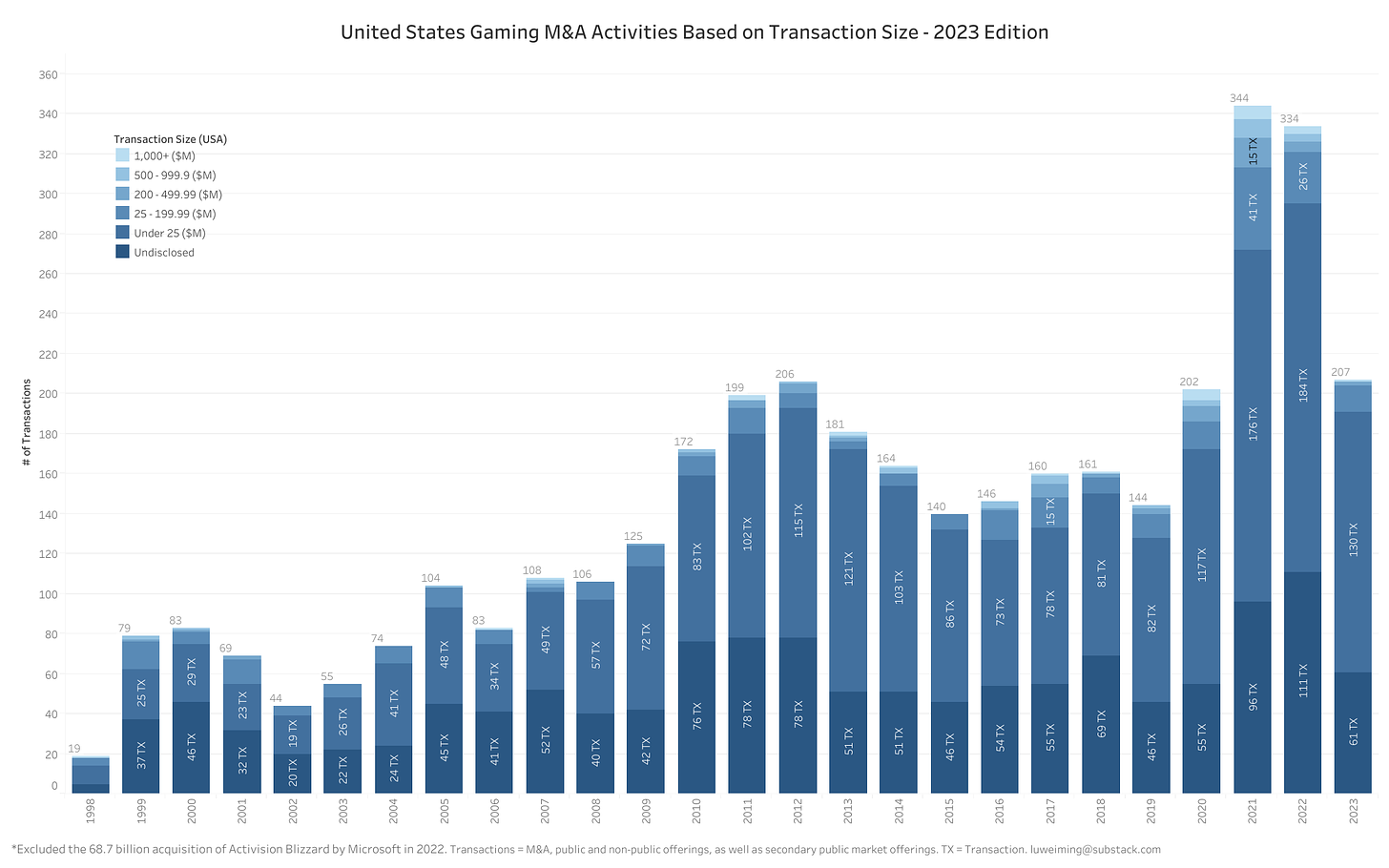

As expected, the post-pandemic M&A frenzy across all regions subsided. North America, led by the US, holds onto its crown as the leader in both transaction volume and total transaction value, followed by EMEA, APAC, and LATAM.

The US market painted a steady picture in 2023 after the spike in transaction volume in 2021 and 2022. Intriguingly, while the total transaction value plummeted from its peak in 2022, the overall transaction volume remained surprisingly steady.

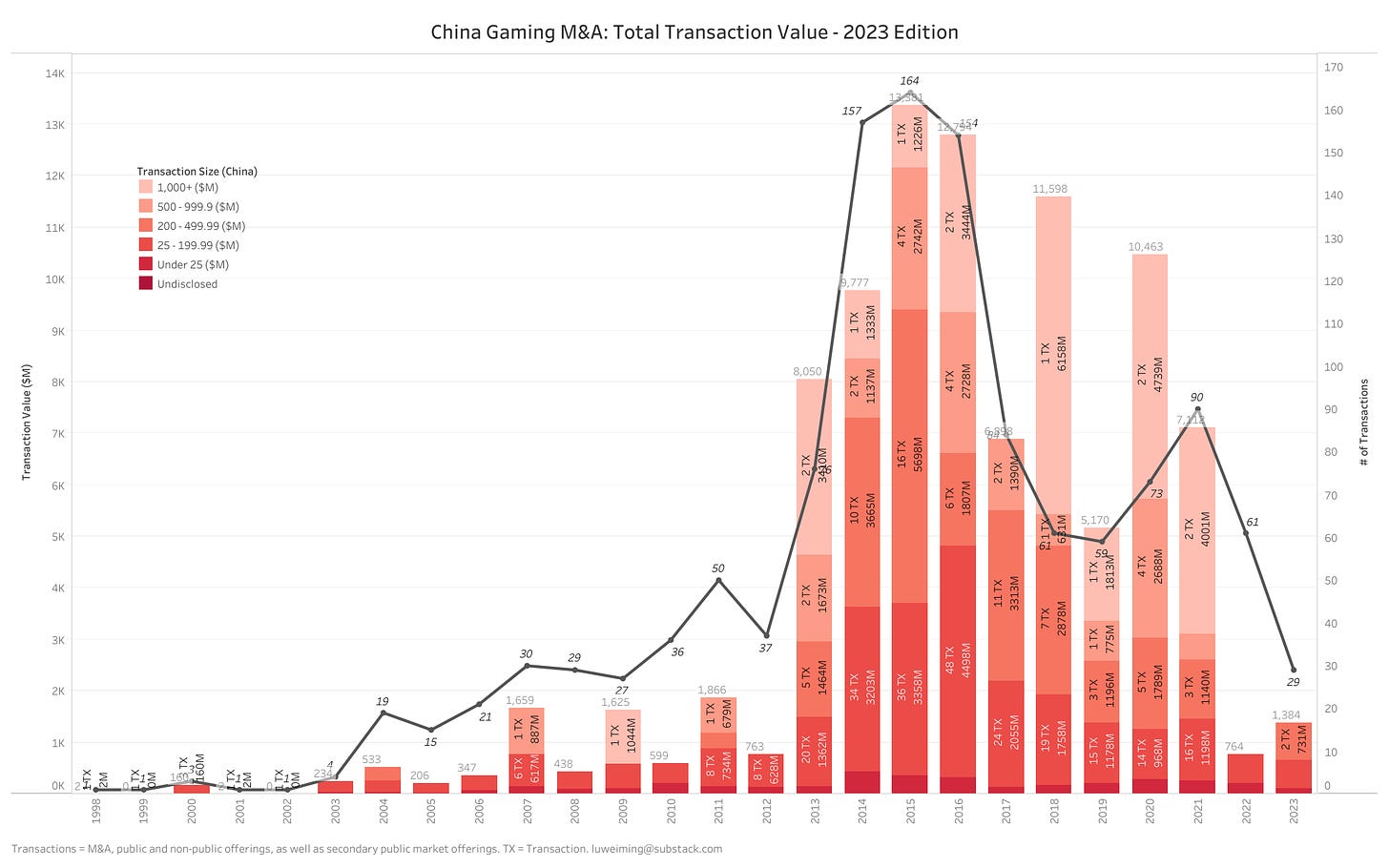

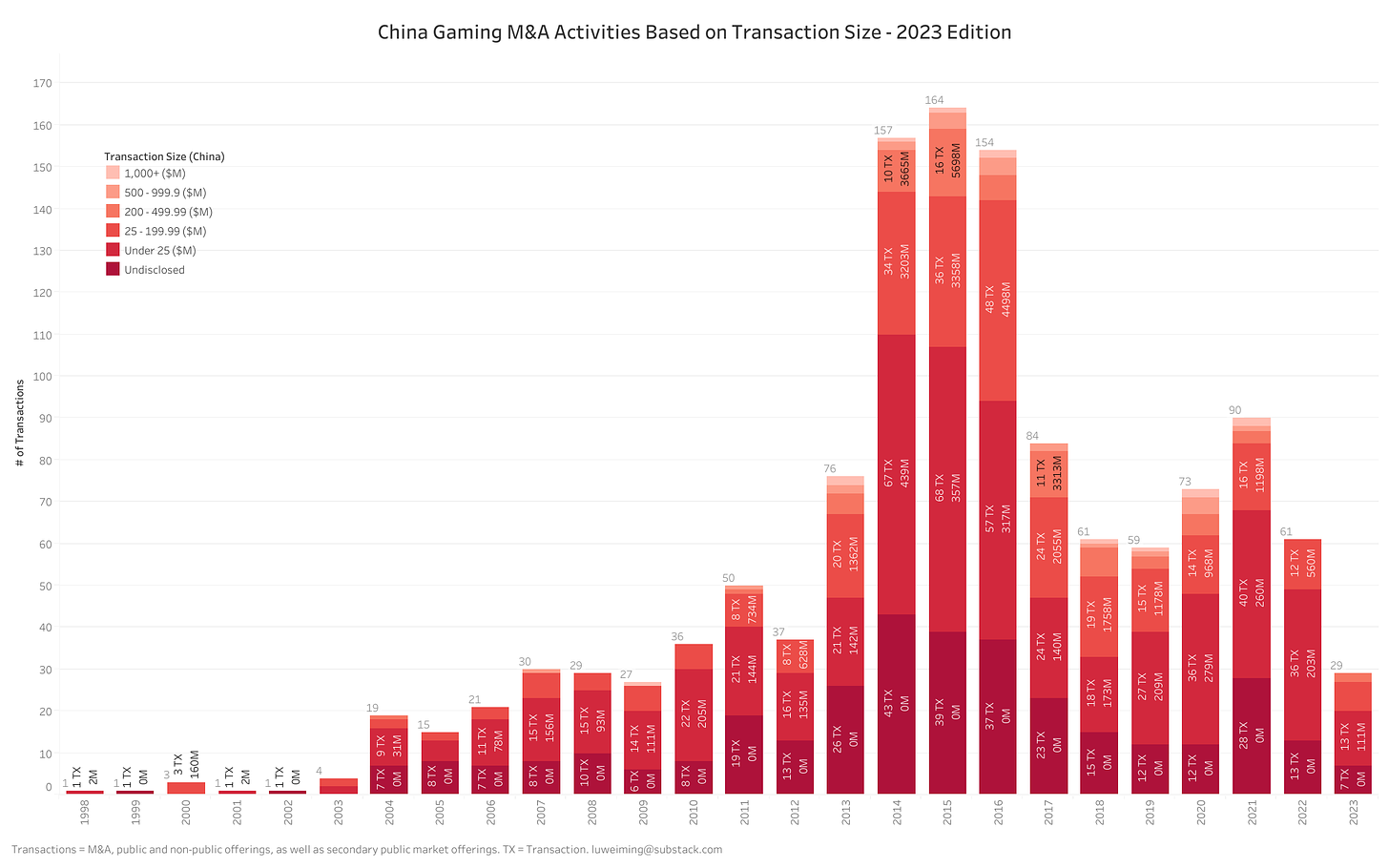

APAC presents a contrasting narrative. The total transaction value dropped disproportionately compared to NA and EMEA, largely due to China's waning M&A activity. As of December 28, 2023, China saw only 29 transactions for the year, a stark contrast to its 2015 peak of 164 transactions. It's a steady decline, with a brief COVID-lockdown-induced bump in transaction value largely driven by three large secondary listings in Hong Kong. The last time China witnessed such a low transaction value similar to 2022 and 2023 goes all the way back to 2010.

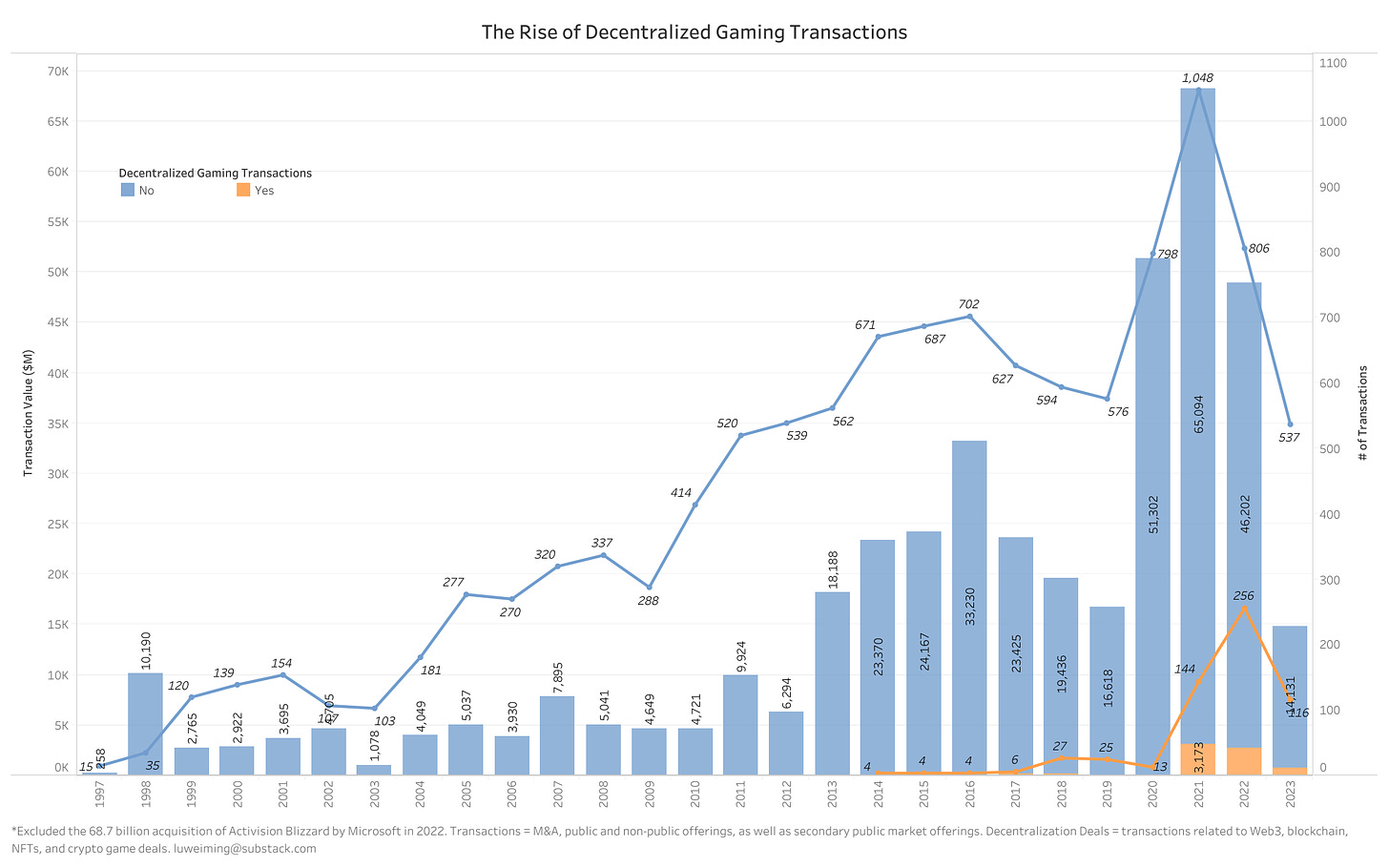

Lastly, although it's not the main focus here, the volume of transactions on decentralized gaming platforms has seen a significant increase. While their impact on the overall transaction value remains modest (approximately 5.7% in 2023), their prevalence (constituting 24.11% of all transactions) suggests a growing interest in this emerging sector.

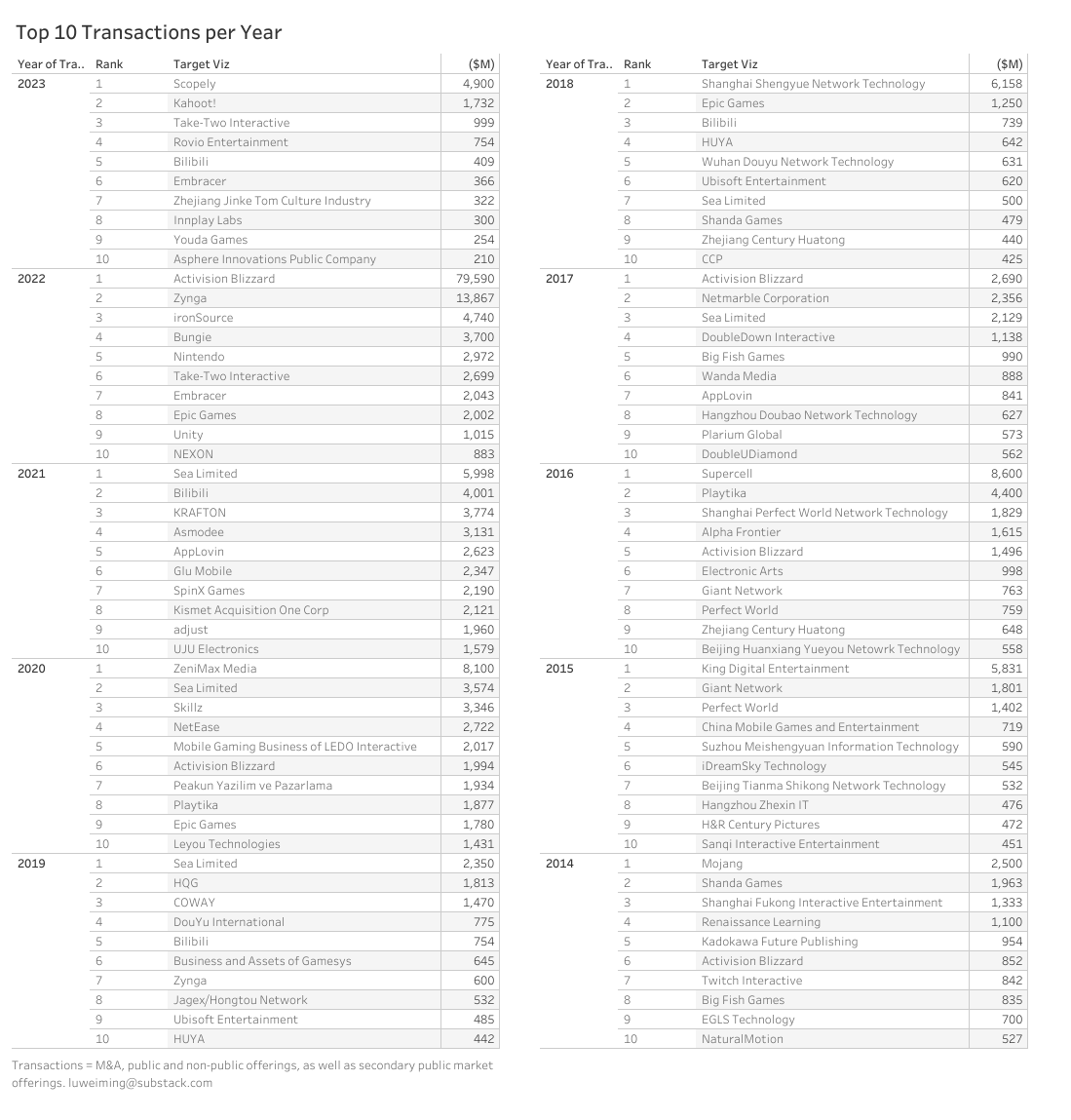

Billion-dollar transactions are no longer commonplace among the top 10 transactions.

The above charts and tables do not include all of Savvy Games Group and Public Investment Fund’s investments in gaming in the list below.

Here is PIF’s current $50 billion+ gaming portfolio according to PocketGamer: (Except #12)

Scopely - $4.9bn (100% as of July 2023)

Electronic Arts - $2.98bn (9% as of March 2023)

Take-Two Interactive - $1.36bn (6.8% to 14.9% as of March 2023)

Activision Blizzard - $3.3bn (roughly 4.9% as of March 2023). Likely see a $5 billion cash total in return after the Microsoft transaction closed

Nintendo - $3.8bn (8.3% stake as of Feb 2023)

Nexon - 88.5M shares (10.23% stake as of June 2023)

Embracer Group - $1bn (8.1% stake as of June 2022)

NC Soft - $700M (6.69% as of Feb 2022)

SNK Corp - $600M? (96% as of Feb 2022)

ESL & FACEIT - $1.05bn + $500M (100% January 2022)

Savvy Gaming Fund $30 billion+

VSPO - $265M (Feb 2023)