In today's economic climate, business operators find themselves grappling with an unprecedented array of challenges. With each passing month, we are confronted with a maze of crosscurrents and conflicting signals. While economists continue to engage in a heated debate about the likelihood of a recession, a soft landing, or no landing at all, the stark reality of higher-for-longer is reshaping the narrative that prevailed just six months ago – the anticipated rate cuts in 2023.

Waves of Debt Are Maturing with over 2 Trillion

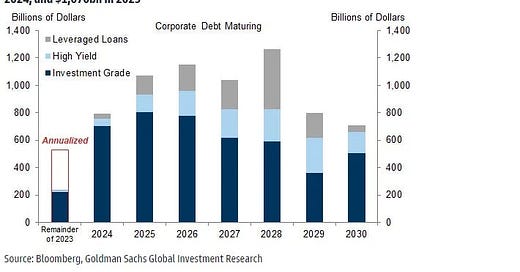

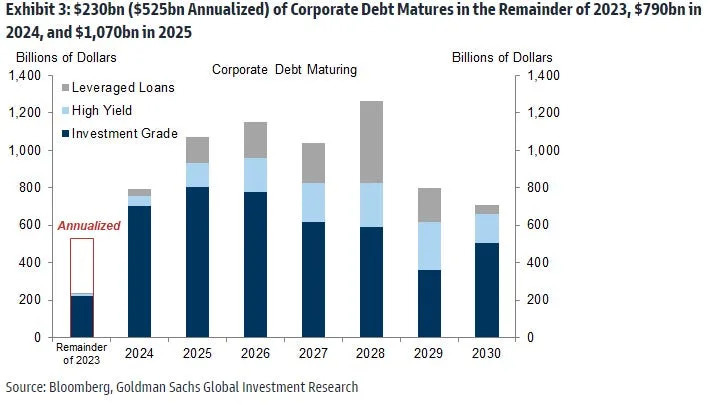

Among the certainties within the current atmosphere of uncertainty, a looming corporate debt wall of more than $2 trillion is set mature over the next two years. Goldman Sachs estimates that corporate debt maturities will be $230 billion for the rest of 2023, $790 billion in 2024, and $1.07 trillion in 2025, representing a combined 16% of all corporate debt. There's another $4+ trillion in corporate debt set to mature from 2026 through 2030.

Signs of Cracks

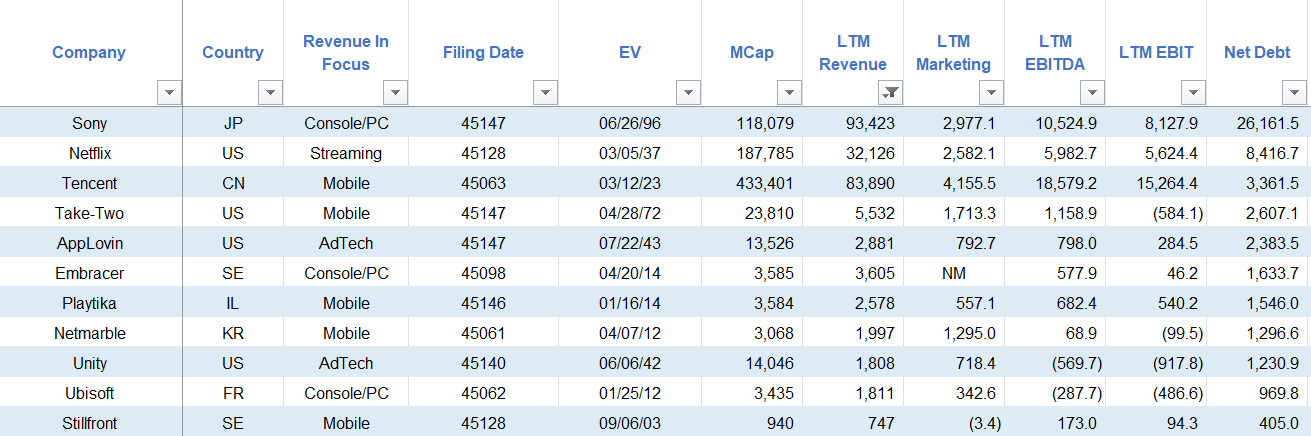

The implications of this debt scenario extend even into the realm of gaming companies. Broadly speaking, tech companies, including gaming, have showcased robust balance sheets and their ability to service their debts. In my January 2023 analysis of M&A Funding Capacity, the majority of companies with a market capitalization of $200 million or higher had minimal to negligible debt. Among the pool of 114 companies analyzed, only 22 have positive net debt. Importantly, 21 out of these 22 companies have positive EBITDA, and 94 out of 114 firms had positive EBITDA in the preceding twelve months as of January 2023. Such metrics shed light on the health of these companies' financial conditions at the time.

However, signs of strain have begun to emerge. Even without immediate maturities, companies may face liquidity concerns when managing mounting interest payments and debt obligations amid a deteriorating business environment. For companies burdened with higher net debt to EBITDA ratios, these challenges could intensify, particularly if interest rates remain elevated when debt refinancing becomes necessary. While companies have implemented strategies to recalibrate and tighten their belts, the scope for cost reduction has its limits. Sustaining short-term boosts requires a return to growth trajectories.

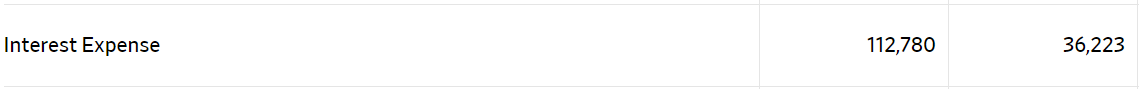

Notably, the net debt to EBITDA ratios for Netmarble has more than doubled in just six months, going from 9.28 to 26 times, accompanied by declining revenues and profit margins. The company’s interest expense also tripled from 36,223 million Won in 2021 to 112,780 million Won in 2022. Whether this spike can be attributed to rapid interest rate hikes enacted by global central banks or related to a $1.4 billion short-term loan secured for the acquisition of SpinX in August 2021 remains unclear. Unfortunately, the Korean Stock Exchange's English version provides limited insights into such details, focusing primarily on high-level financials. The 1.4 billion loan, with a tenor of 360 days and priced at 200 basis points over Libor, was detailed by GlobalCapital.

Not All Debts Are the Same

When delving deeper into companies carrying substantial debt, the situation paints a very different picture for each.

Unity

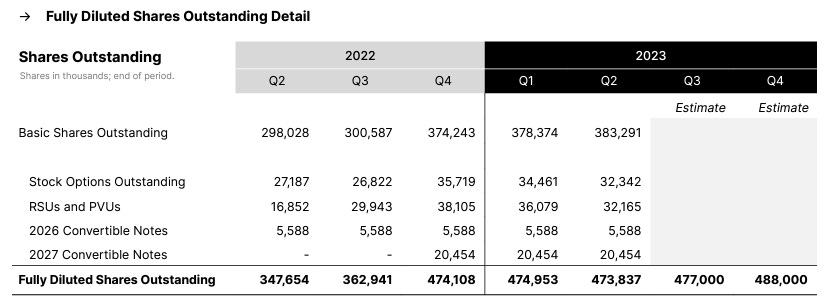

Take Unity, for instance. It possesses a net debt of $1.23 billion, balancing it against cash reserves of $1.64 billion and a debt portfolio of $2.87 billion as of June 30, 2023. The bulk of this debt stems from convertible notes, which blend elements of debt and equity.

2026 Notes carry a 0% interest rate with a conversation price of $308.72 per share of Unity’s common stocks. The 2026 Notes will mature on November 15, 2026

2027 Notes carry a 2% interest rate with a conversation price of $48.89 per share of Unity’s common stocks. The 2027 Notes will mature on November 15, 2027

A convertible bond or convertible note or convertible debt (or a convertible debenture if it has a maturity of greater than 10 years) is a type of bond that the holder can convert into a specified number of shares of common stock in the issuing company or cash of equal value. It is a hybrid security with debt- and equity-like features from Wikipedia.

Unity's stock price stands at $35.32 per share with a market cap of $13.54 billion, as of August 15th. The chance of the 2026 note holders converting their notes to stocks at $308.72 per share appears less likely given the substantial climb required. The stock price would need to surge nine-fold by November 15, 2026, to make conversion an attractive proposition. Realistically, this seems less likely in the current economic climate, where the shadow of a looming recession could prompt investors to adopt a more cautious stance. Anticipating the road ahead, it’s likely that the company will need to look for other avenues or to refinance to repay the $1.7 billion 2026 note when is due. It's worth noting that the company is likely getting about 5% parking the money in T-bills ($50 million in interest per annum for $1 billion). Additionally, locking in longer-term 2-year notes at a rate of 4.959% is also a possible option.

The 2027 notes are a lot more interesting. The conversion price of $48.89 is in close proximity to the current stock price of $35.32. If a conversion did occur, existing investors would see roughly a 4.6% dilution of their existing positions. If Unity's ability to sustain a positive cash flow or generate profits between now and 2027. Such financial health would enable the company to buy back its stocks when the price dip below the conversion price of $48.89. This intriguing spread would determine the discount to the 2027 notes, hinging on the assumption that the stock price would stay above $48.89 by the time these notes reach maturity.

AppLovin

AppLovin presents a slightly less favorable debt scenario compared to Unity, yet there's a silver lining to the story, as the company continues to exhibit robust growth in its operations. The recent release of the Q2 earnings report indicates a promising trajectory, suggesting a year-over-year revenue growth of 10.8%. AppLovin's strategic cost-cutting initiatives, implemented since the previous year, have played a pivotal role in this progress. A noteworthy feat for AppLovin has been its success in optimizing the net debt to EBITDA ratio, a useful metric for assessing financial health. This ratio, which stood at over 4, has now been prudently lowered to 2.99, underscoring the company's commitment to enhancing its financial stability.

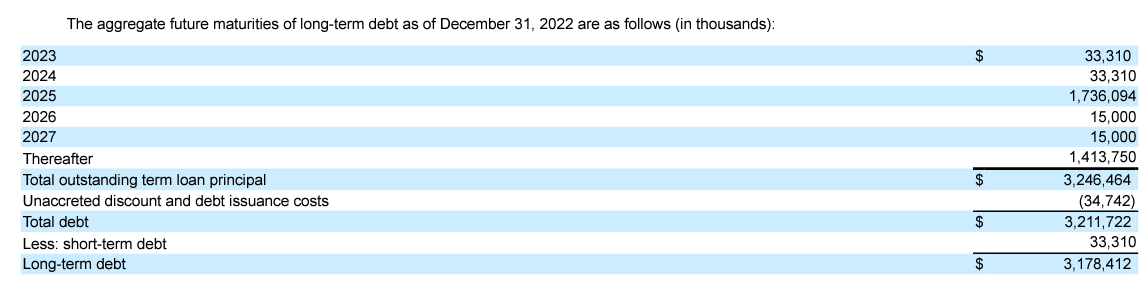

Peering into the financial particulars, AppLovin carries a net debt burden of $2.393 billion, with cash reserves of $876.23 million and a debt sum of $3.27 billion as of June 30, 2023. The majority of this debt is structured through credit agreements and revolving credit facilities, typically subject to floating interest rates.

At December 31, 2022, the interest rates on the Initial Term Loans and Sixth Amendment Term Loan stood at 7.32% and 6.67% plus a fee of 0.25% per annum associated with the unused commitments under the Revolving Credit Facility. A noteworthy aspect of AppLovin's debt management strategy is its proactive approach to mitigating interest rate risks. This has been achieved through interest rate swaps with a notional amount totaling $1.8 billion. In relation to these interest rate swaps, the company recorded a net gain of $21.4 million and $15.7 million during the three and six months ended June 30, 2023, respectively.

In tandem with these financial maneuvers, it's notable that the company's interest expenses have risen by 51% compared to the same six-month period ended on June 30.

Under the current credit agreement, the principal amounts of the Initial Term Loans and the Sixth Amendment Term Loans are due on August 15, 2025, and October 25, 2028, respectively. The Revolving Credit Facility will mature on February 15, 2025.

TAKE-TWO

Lastly, Take-Two Interactive has a net debt of $2.22 billion, with $1.27 billion in cash and $3.49 billion in debt as of June 30, 2023. The company has a more conventional debt profile, with the bulk of the debt being in longer-term fixed-rate bonds, with a small mix of convertible notes, term loans, and credit agreements.

Below is a quick overview of the company’s interest expense for Q2 2023.

The End of Easy Money

In the previous era of low-interest rates, companies, and private equities thrived on access to easy credit, employing strategies that borrow the most money to buy companies and cut costs to make a profit. However, the paradigm shift to higher interest rates, with a striking 500 basis point increase over the course of a year, has put companies that heavily relied on expansive growth strategies under significant stress. Those burdened with unsustainable debt and ongoing financial losses now find themselves particularly vulnerable. The repercussions of these rate hikes are yet to be fully materialized, necessitating a span of a couple more years for their full effects to unfold. Moreover, a critical lens on the EBITDA to interest coverage ratio reveals a potential for even greater disparity, as the reported EBITDA figures are often substantially adjusted. The companies that are at a higher risk of facing negative consequences from refinancing their debt at elevated interest rates are usually those that have failed to achieve profitable growth within 12 months following their initial cost-cutting measures.

Extending a heartfelt shoutout to JK

at GameMakers for being an incredible source of support right from the beginning of my journey with Substack. 🚀 Creating this space to share my musings, ranging from intriguing reflections to potentially valuable insights, was a step into the unknown. Uncertain about my target audiences and their preferences, I embarked on an initial goal of 150 subscribers within a year.Today, I'm thrilled to announce that this Substack community has already grown to encompass a remarkable 543 individuals in just six months! 🎉 Many of you are familiar with JK, but for those who haven't crossed paths with his work, I wholeheartedly encourage you to subscribe to GameMakers' newsletter on their official website at https://www.gamemakers.com/, as he has transitioned his newsletter away from Substack. Discover profound insights into the gaming industry and stay updated with the latest news.🌟