Financial Comparison of Gaming-Related Public Companies and M&A Capacities - 2024 Edition

APAC's Cash War Chest: Will it fuel a global M&A spree in 2024?

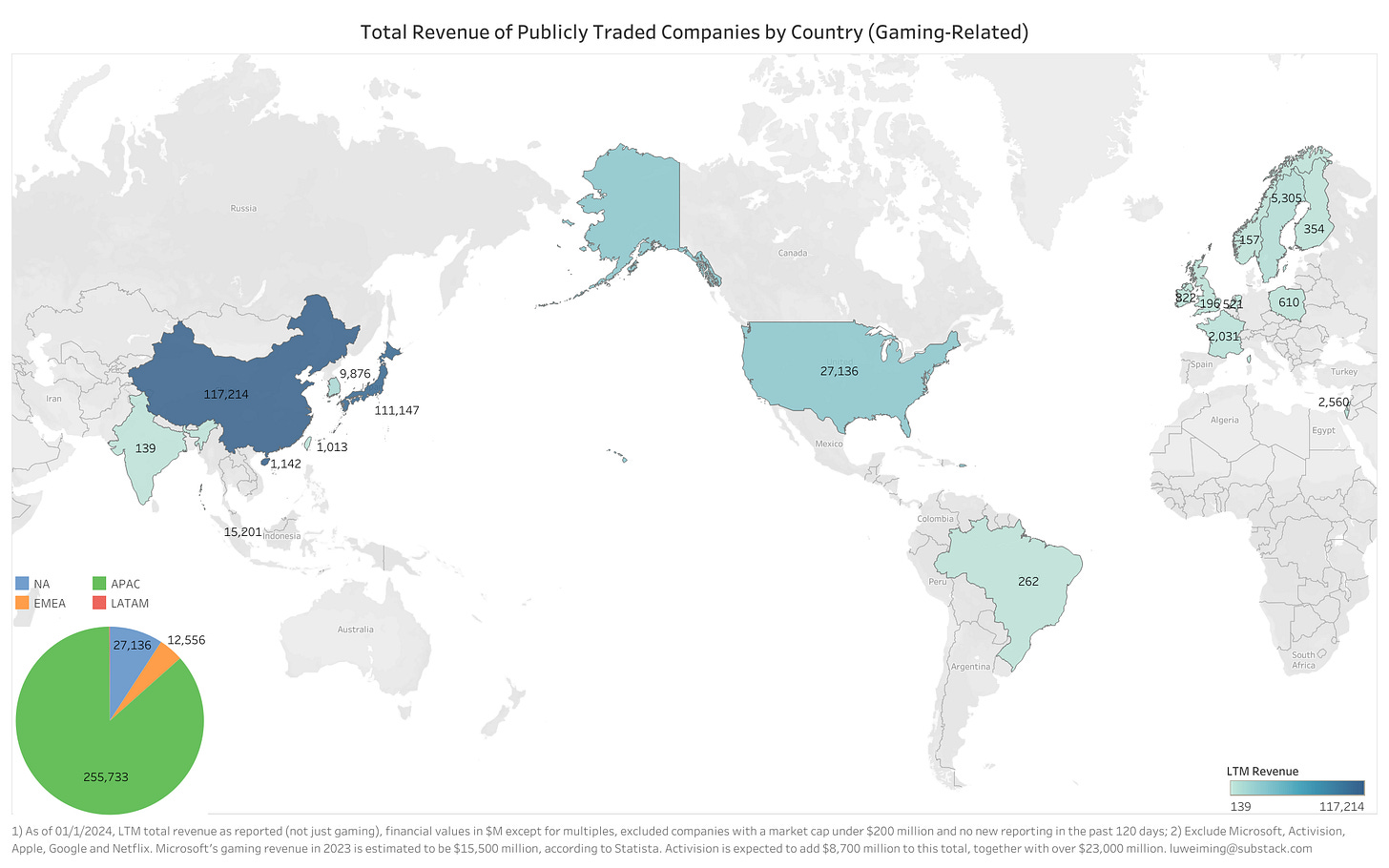

APAC Made Up the Majority of Global Gaming Revenue in 2023

The landscape of the video game industry has undergone a significant transformation, particularly since the rise of mobile gaming. Notably, the total revenue of China's mobile gaming market eclipsed the US in 2015. Based on my rough estimate, 2023 could have marked the year that China's total gaming revenue from publicly traded companies surpasses the U.S for the first time.

Breaking it down:

China: $117.21 billion - (excluding 69% of Tencent’s non-gaming revenue of $82.06 billion) = $60.59 billion.

U.S. (excluding Netflix, Apple, and Google): $27.14 billion + (estimated $23 billion gaming revenue from Microsoft and Activision for 2023) = $50.14 billion

APAC Companies in Prime Position for Future Acquisitions:

This phenomenon extends beyond just revenue. While North America and EMEA companies hold a combined net cash of 1.65 billion, APAC giants boast an astounding 61,03 billion, nearly 37 times more! This financial war chest, propelled by Netease and Nintendo's 13+ billion reserves from each, translates to a potential leverage of over 222 billion for APAC (Using the same assumption in 2023 for max leverage at 4X EBITDA +/- Net Debt). That's a staggering 11 times the combined purchase capacity of their Western counterparts! Companies like Take-Two, Playtika, AppLovin and Embracer, might have been on an acquisition spree in recent years, but they would need time to digest their previous moves before resuming their M&A activities. Although my prediction from last year might have been a bit premature, with the peak interest rate likely behind us, this small tailwind may reignite the trend initiated by SEGA last year, encouraging strategic acquisitions or content library expansion overseas from the region.

Year of Efficiency?

Across the board, marketing expenses as a percentage of revenue have been reduced, highlighting a focus on efficiency and profitable growth. This trend, however, bypasses Netmarble, which maintains a higher leverage profile and continues to invest heavily in marketing.

Net Interest Income/Expense: East vs. West

In terms of net interest income and expense, companies in APAC have received a substantial 2.16 billion in interest income, while companies in North America and EMEA have collectively spent 780 million on interest expenses.

Domestic Restructuring and International Expansion

China boasts the most publicly traded gaming companies globally, with many excluded from this analysis due to a 200 million market cap threshold. As potential new gaming regulations may disproportionately impact smaller players, expect to see a consolidation within China, with potential expansion overseas that could play a significant role if the policies are supportive of such a move.

Check out the table below for some more fascinating insights! I won't spill the beans – I'll let you uncover these interesting details on your own.

Lastly, according to a recent interview by PocketGamer, Savvy Games Group stated: “Approximately 75 percent of our capital allotment has not yet been invested,” which means approximately $25 billion. That would generate $3.6 million in interest income each day or $41.61 every second in T-bills. Savvy Games Group can buy every publicly traded company in EMEA for a total of $20.75 billion with $4.25 billion in change since Kahoot! is already taken.

What else is on their shopping list, and which ones will they increase their stake to 100% in their current portfolio, together with the Saudi Arabian state’s Public Investment Fund?

Here is PIF’s current $50 billion+ gaming portfolio according to PocketGamer: (Except #12)

Scopely - $4.9bn (100% as of July 2023)

Electronic Arts - $2.98bn (9% as of March 2023)

Take-Two Interactive - $1.36bn (6.8% to 14.9% as of March 2023)

Activision Blizzard - $3.3bn (roughly 4.9% as of March 2023). Likely see a $5 billion cash total in return after the Microsoft transaction closed

Nintendo - $3.8bn (8.3% stake as of Feb 2023)

Nexon - 88.5M shares (10.23% stake as of June 2023)

Embracer Group - $1bn (8.1% stake as of June 2022)

NC Soft - $700M (6.69% as of Feb 2022)

SNK Corp - $600M? (96% as of Feb 2022)

ESL & FACEIT - $1.05bn + $500M (100% January 2022)

Savvy Gaming Fund $30 billion+

VSPO - $265M (Feb 2023)