M&A Funding Capacity of Public Gaming Companies in 2023

M&A Dry Powder Totaling $65.28+ Billion Remains On the Sidelines

Quick Recap of M&A Activities in 2022

2022 was a historic year for gaming M&A, with a record-breaking $100+ billion in gross transaction value. This included two mega deals worth over $10 billion each (Activision $68.7B and Zynga $12.7B), all first-time for the industry. The record-breaking M&A activity in the gaming industry was somewhat overshadowed by reports of layoffs and a deteriorating economic outlook. In this post, I will analyze the total available M&A funding capacity of publicly-traded gaming companies worldwide. I will also provide a breakdown by region and a high-level overview of their financial strength for M&A.

M&A Funding Capacity

According to my analysis, publicly-traded gaming companies1 (excl. Microsoft, Activision, Tencent, and Facebook/Meta)2 have a net cash total of over $65.28 billion, with 93.95% ($61.32 billion) coming from APAC, Netease and Nintendo account for a third of the APAC sum. Companies in North America (NA) and Europe, Middle East, and Africa (EMEA) were less conservative with their spending on growth and acquisitions in recent years, with Roblox being the only company in these regions with over $1 billion in net cash on hand.3

However, it's important to note that net cash isn't the only indicator of a company's financial strength. By applying a 4X EBITDA leverage4, we can see that the total firepower of these companies increases to $189.86B. APAC continues to lead for the majority of this total, with 83.06% of the funding capacity. Sony takes the top spot with over $35B, followed by Nintendo with almost triple that amount at $28.13B. Netease, Netflix and Electronic Arts round out the top five, with $25.04B, $13,77B and $7.18B in funding capacity, respectively.

It's worth noting that not all companies will or can utilize a 4X EBITDA leverage in their M&A efforts. This measure is intended to illustrate the maximum affordability of these companies in simple terms. Additionally, it's important to note that companies have different M&A strategies or limitations. For example, Nintendo traditionally doesn't engage in direct M&A with gaming developers and publishers, and Sony and Netflix may not be ready to leverage their entire business into gaming. All stock merge deals are also not affected much by these measures.

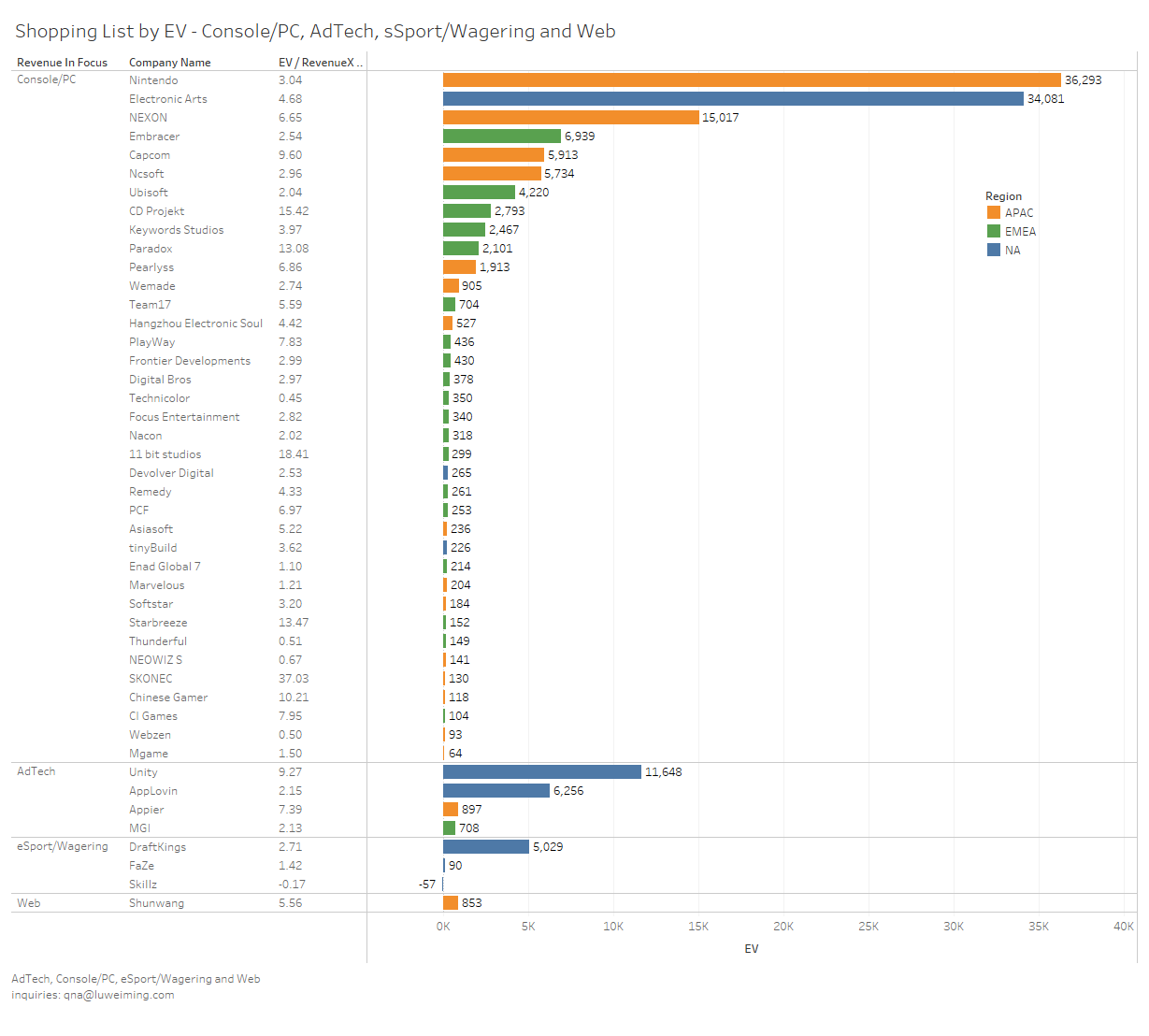

Gaming Companies by Valuations ($MM)

This list includes only publicly traded and companies. Feel free to plug in any privately held companies (e.g., Epic Games valued at $32B in 2022, Scopely valued at $3.3B in 2020) for your own analysis.

(For the sake of simplicity, I won’t delve into factors such as synergy, share classes, voting power, takeover defenses, etc.)

If you're interested in the typical deal size and the number of transactions in the gaming M&A market, here is some information I previously shared on the topic.

What’s ahead?

According to estimates from Newzoo in December 2022, the global games market is expected to generate $184.4 billion in revenue in 2022, marking a decrease of 4.3% compared to the previous year. This marks the first time that Newzoo has recorded a decrease in revenue for the gaming industry since it began tracking the market. However, the gaming industry has a history of resilience, having consistently grown in the past two decades in different economic cycles, including during the Great Financial Crisis of 2008. This year will be a test of that resilience once again.

Since the Great Financial Crisis, companies that have used strategic acquisitions to drive growth, such as Take-Two, Microsoft, Tencent, Activision, Zynga, and EA, have been the obvious beneficiaries. For example, Activision acquired Blizzard for $18.9 billion in 2008. Zynga, in particular, has undergone a spectacular turnaround through a series of acquisitions, despite previously struggling and, at one point, trading at a value close to its net cash plus the value of its building.

In 2023, it is likely that "austerity" and "survival" will become the focus for most companies, as the current environment makes "growth" a luxury. Many companies' runways are getting shorter and there is no indication of when the macro environment will improve. These factors may prompt further consolidation in certain areas.

For financially strong companies still seeking growth, the current low market multiples could be a strong tailwind. As the gaming industry shifts towards a platform-agnostic experience, acquiring companies with proven products, loyal audiences and talented teams at low EBITDA multiples may be a less risky option than investing millions of dollars in marketing with a hoped-for 12~24 months ROI just to breakeven (RPG, MMO, social casino and strategy genres). Alternatively, partnering with someone with good distribution power may also be a viable option.

As we put 2022 in the rearview mirror, it was a year like no other. It will be interesting to see how gaming companies adapt and evolve in the face of economic uncertainties in 2023.

Excl. companies with a market cap under $100MM as of 12/30/2022

Excl. the outliers: Microsoft, Meta, and Tencent. Activision is unlikely to do any meaningful size M&A anytime soon

“Total liability” may be overlooked as debt by some, but the majority of Roblox’s current liability is “deferred revenue” which is unlikely to be required to be paid back. See Q3 Earning and Revenue Recognition on Page 6 for detail

If a company has a positive EBITDA and positive Net cash = 4x EBITDA + Net Cash

If a company has a positive EBITDA and positive Net debt = 4x EBITDA - Net Debt

If a company has a negative EBITDA and positive Net cash = Net Cash

If a company has a negative EBITDA and negative Net cash = 0 (for simplicity)